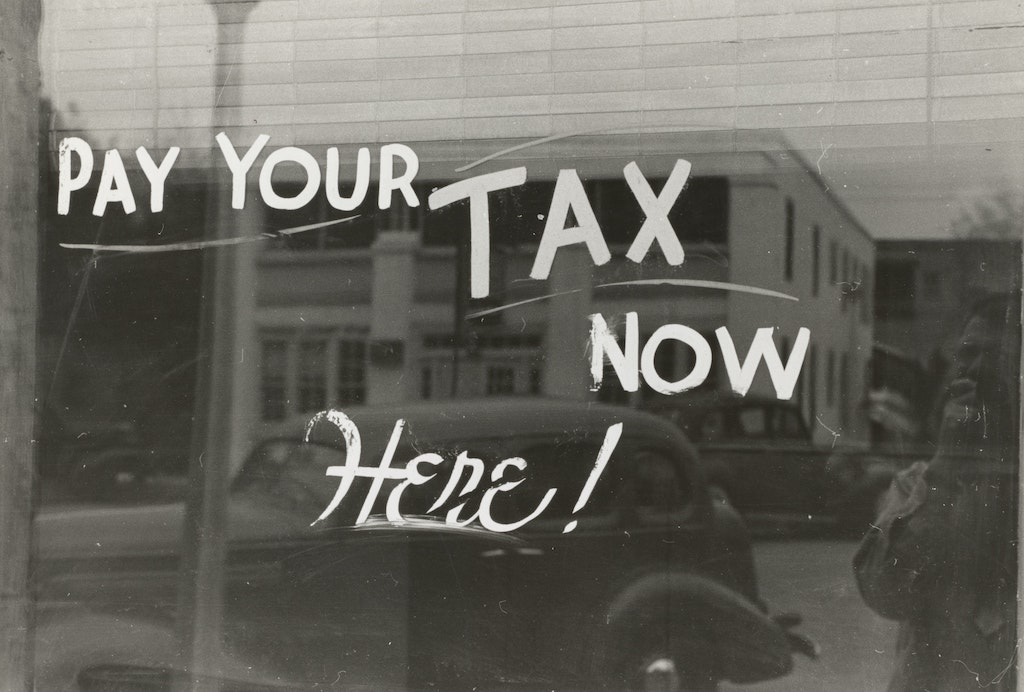

Change and Taxes: Inevitable

Like most things in life, there are pros and cons to changes. The more complex the content of that change, the more controversy, cheerleading and protesting we see. We are in the midst of change and it’s unclear as to whether the wind is blowing us to shore or out to sea. My father, a lifelong boatman, would say to hike up the sails and man the decks, it’s time to catch the wind.

The elections have brought uncertainty in some things, but some black and white changes in others. Proposition 19 offers clear guidelines as to how property taxes will change for seniors and for families or trusts holding generational real estate assets.

Passing real property assets from one generation to the next has been an incredible boon to families who could afford to do so. Not only did the property remain in the family, in most cases increase in value, the tax assessment went largely unchanged when Grandma bought the home in the forties. Proposition 13 was responsible for this well intentioned bill that aimed to help keep people in their homes. The argument was that if homes are assessed at market values and the market is going up, homeowners would be forced out of their homes due to high taxes.

That argument was carried across sales that went from one family member to another through inheritance. Families possessing real estate assets could pass those assets to their heirs and the heirs maintained grandma’s tax basis.

The result, fifty years later, is that some homes that have not changed hands are paying very low taxes, and homeowners feel ‘stuck’ in their homes for the inability to pay market rate property taxes. This hasn’t worked out well for younger generations who bear the brunt of the share of market rate taxes, and one could argue that it is an unreasonable advantage for those families whose wealth can be passed on through real estate.

Proposition 19 addresses this issue and also allows some older or disabled homeowners to transfer their current low property tax rate (which may be based on an original sales price of $65,000 when the home is now worth a million) with them when they move - even to a more expensive home. There are additional provisions for the same potability for victims of natural disasters.

Prop 19 will allow some homeowners to sell their homes and move to a new one without paying market rate property taxes. Instead, the total property tax would be based on the original tax basis plus the difference between the sales price of the property being sold and the sales price of the one being purchased.

For instance, a home that was purchased for $400,000 and sold for a million carries a tax basis of $400K. That homeowner buying a new million dollar home will still pay property taxes on $400K. If the homeowner buys a home for $1,300,000, the tax rate would carry the $400K basis and tax the difference in sales prices ($300K) at the current valuation.

Homeowners who inherited property are still eligible to carry the original tax basis, if they live in the property as a first or second home. For families whose income is based on rental income from generational properties, they will find a new property tax bill in February 2021.

For more information on Proposition 19, call me or read CAR’s summary of the Bill here.